FSBOs Must be Ready to Negotiate

FSBOs Must Be Ready to Negotiate

Posted: 05 Nov 2013 04:00 AM PST

In a recovering market, some sellers might be tempted to try and sell their home on their own (FSBO) without using the services of a real estate professional. The real estate agent is a trained and experienced negotiator. In most cases, the seller is not. The seller must realize the ability to negotiate will determine whether they get the best deal for themselves and their family.

In a recovering market, some sellers might be tempted to try and sell their home on their own (FSBO) without using the services of a real estate professional. The real estate agent is a trained and experienced negotiator. In most cases, the seller is not. The seller must realize the ability to negotiate will determine whether they get the best deal for themselves and their family.

Here is a list of some of the people with whom the seller must be prepared to negotiate if they decide to FSBO:

- The buyer who wants the best deal possible

- The buyer’s agent who solely represents the best interest of the buyer

- The buyer’s attorney (in some parts of the country)

- The home inspection companies which work for the buyer and will almost always find some problems with the house.

- The termite company if there are challenges

- The buyer’s lender if the structure of the mortgage requires the sellers’ participation

- The appraiser if there is a question of value

- The title company if there are challenges with certificates of occupancy (CO) or other permits

- The town or municipality if you need to get the Cos permits mentioned above

- The buyer’s buyer in case there are challenges on the house your buyer is selling.

- Your bank in the case of a short sale

The Importance of Curb Appeal

|

Importance of Curb Appeal [INFOGRAPHIC] Posted: 01 Nov 2013 04:00 AM PDT Today we are featuring an infographic originally created for Door Emporium by Optimal Targeting. – The KCM Crew |

10 Hidden Hazards When Buying Foreclosures

10 Hidden Hazards When Buying Foreclosures

Posted: 23 Oct 2013 04:00 AM PDT

We are pleased to present, Amanda Kostina, as our guest blogger today. Amanda is a writer for Whitefence.com. – The KCM Crew

Buying a foreclosed home can seem like a dream. What could be better than getting a home for a fraction of the market value? Some may even say that the deals sound like they could be too good to be true. In some cases, those doubters aren’t too far off the mark. There are some hidden dangers in buying foreclosure properties that, if you’re not aware of them, could be disheartening and disappointing. If you are pursuing this route in buying your new home, be sure to look out for these hazards and hidden costs.

Buying a foreclosed home can seem like a dream. What could be better than getting a home for a fraction of the market value? Some may even say that the deals sound like they could be too good to be true. In some cases, those doubters aren’t too far off the mark. There are some hidden dangers in buying foreclosure properties that, if you’re not aware of them, could be disheartening and disappointing. If you are pursuing this route in buying your new home, be sure to look out for these hazards and hidden costs.

- Destruction of Property – A sad truth about foreclosure properties is that they have often been purposely destroyed. Sometimes the homeowners do this out of frustration over losing their homes, or out of simple carelessness when they realize their home is irretrievably gone after too many missed mortgage payments. If the homeowners have not destroyed the property themselves, there is also a chance that the home has been vandalized by other people because it has been left sitting empty.

- Poor Maintenance – If homeowners were unable to afford their mortgage payment, they almost certainly were unable to perform routine maintenance on the property. Problems can be as minor as a few leaky faucets, or as major as damaged roofing or central units.

- It May Be Unclean – A house being left unoccupied for a significant amount of time can mean it will be unclean, either through neglect on the part of the former owners or normal depreciation as the property is left uninhabited and not looked after. When a homeowner is selling the home, they will scrub the house clean or hire a cleaning service to entice buyers. A foreclosed home will not have this benefit. Depending on how long it was left and what condition it is in, there may even be vermin or termites to deal with.

- Undesirable Renovations – Sometimes homeowners were in the middle of a renovation when they lost their ability to pay their mortgage, so you can wind up with a half finished project on your hands when you purchase the property. There is also a chance that a garage or basement was turned into a living space to rent out in order to try and offset the cost of the mortgage.

- No Electricity – There is a good chance the electricity will be off in the foreclosed home, so you will have a hard time seeing what you are buying. Depending on the weather it may also be very hot or very cold in the house, and vacancy can take its toll on appliances left behind.

- Personal Property Left Behind – Many homeowners leave items behind, either because they now have no place to put them or because they were locked out of the house before they could retrieve them. You will now be left with the job of disposing of these items if you decide to purchase the property.

- Lack of Landscaping – More than likely, nobody has been maintaining the lawn of a foreclosed home. You may have a yard full of dead grass or a lawn so overgrown it seems like a jungle! Your foreclosed home will almost certainly require some degree of upkeep when it comes to to the landscaping surrounding the structure.

- No Disclosure – Because the owner of the property is a bank and the bank has not actually lived in the house, they have no idea what problems or issues there may be in the home and they have no obligation to tell you even if they did. You will have to get your own home inspection done to uncover potential issues.

- Stripped Bare – You may find your new foreclosed home completely stripped of appliances, copper piping, and anything else that might be worth money. Many times the previous owners do this to try and make back some money on their lost home. Other times, the home was broken into and robbed after the previous owners left.

- Judgments and Liens – Foreclosure properties can sometimes come with titles encumbered by judgments or liens that you may have to pay off to close on the deal.

In short, buying a foreclosed property can be a great way to save money. However, be sure to look into all the potential costs involved before making a final decision. Do the math to determine if you will really wind up saving, or if the property will end up costing you when all is said and done.

Resources: http://www.investopedia.com/articles/mortgages-real-estate/08/foreclosur… http://www.zillowblog.com/2012-08-17/buying-a-foreclosure-watch-out-for-…

Buy Now or Pay More Later? Your Choice!!

|

Forbes: Buy Now or Pay More Later? Posted: 22 Oct 2013 04:00 AM PDT

The article, Should You Buy a Home Now or Pay More Later?, explains: “With mortgage rates creeping up toward 5% as 2013 draws to a close, potential home buyers have some decisions to make — and soon. The danger for potential homebuyers isn’t that mortgage rates are nearing 5.00%; the real threat is that rates could go higher, to 5.50% or even 6.00% in 2014.” The article spells out the financials consequences a buyer would face by waiting. ($67,746 on a $300,000 mortgage). They gone on to identify four things a buyer should take into consideration before delaying a decision to purchase.

Bottom Line The financial advice Forbes gave to their readers was rather simple. Buy now or pay more later!! |

Why You Should Sell Your House Now…

|

Why You Should Sell Your House Now Posted: 15 Oct 2013 04:00 AM PDT

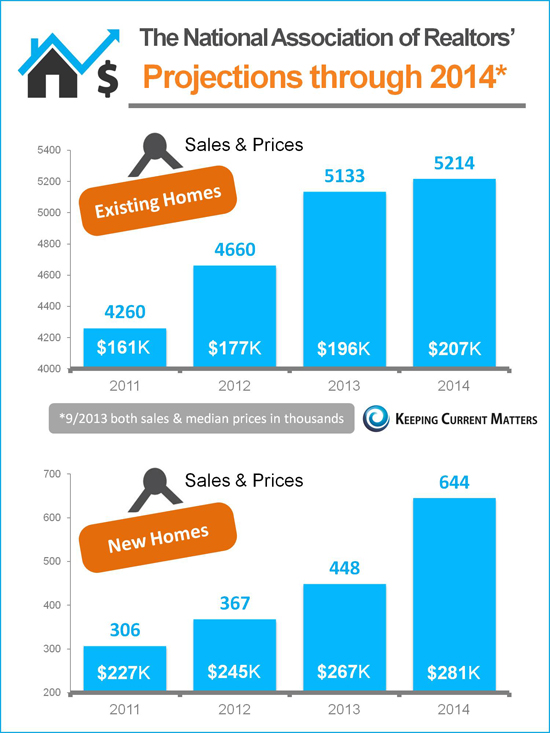

1. Demand Is HighThe most recent Existing Home Sales Reports by the National Association of Realtors (NAR) show a double digit percent increase in sales year-over year; sales have remained above last year’s levels for over 25 months. There are buyers out there right now and they are serious about purchasing. 2. Supply Is Beginning to IncreaseTotal housing inventory is again approaching historic norms of a 5 month supply compared with 4.3 months in January. Many expect inventory to continue to rise as 3.2 million homeowners escaped the shackles of negative equity in the last 12 months and an additional 1.9 million are expected to enter positive equity in the next 12 months. Selling now while demand is high and before supply increases may garner you your best price. 3. New Construction Is Coming BackOver the last several years, most homeowners selling their home did not have to compete with a new construction project around the block. As the market is recovering, more and more builders are jumping back in. These ‘shiny’ new homes will again become competition as they are an attractive alternative for many purchasers. 4. Interest Rates Will Again RiseAlthough Freddie Mac’s Primary Mortgage Market Survey shows that interest rates for a 30-year mortgage have softened recently, most experts predict that they will begin to rise later this year. The Mortgage Bankers Association, Fannie Mae, Freddie Mac and the National Association of Realtors are in unison projecting that rates will be up almost a full percentage point by this time next year. Whether you are moving up or moving down, your housing expense will be more a year from now if a mortgage is necessary to purchase your next home. 5. It’s Time to Move On with Your LifeLook at the reason you are thinking about selling and decide whether it is worth waiting. Is the possibility of a few extra dollars more important than being with family; more important than your health; more important than having the freedom to go on with your life the way you think you should? You already know the answers to the questions we just asked. You have the power to take back control of your situation by putting the house on the market today. The time may have come for you and your family to move on and start living the life you desire. That is what is truly important. |

Buyers: Window of Opportunity is Still Open…

|

Buyers: Window of Opportunity Still Open Posted: 30 Sep 2013 04:00 AM PDT

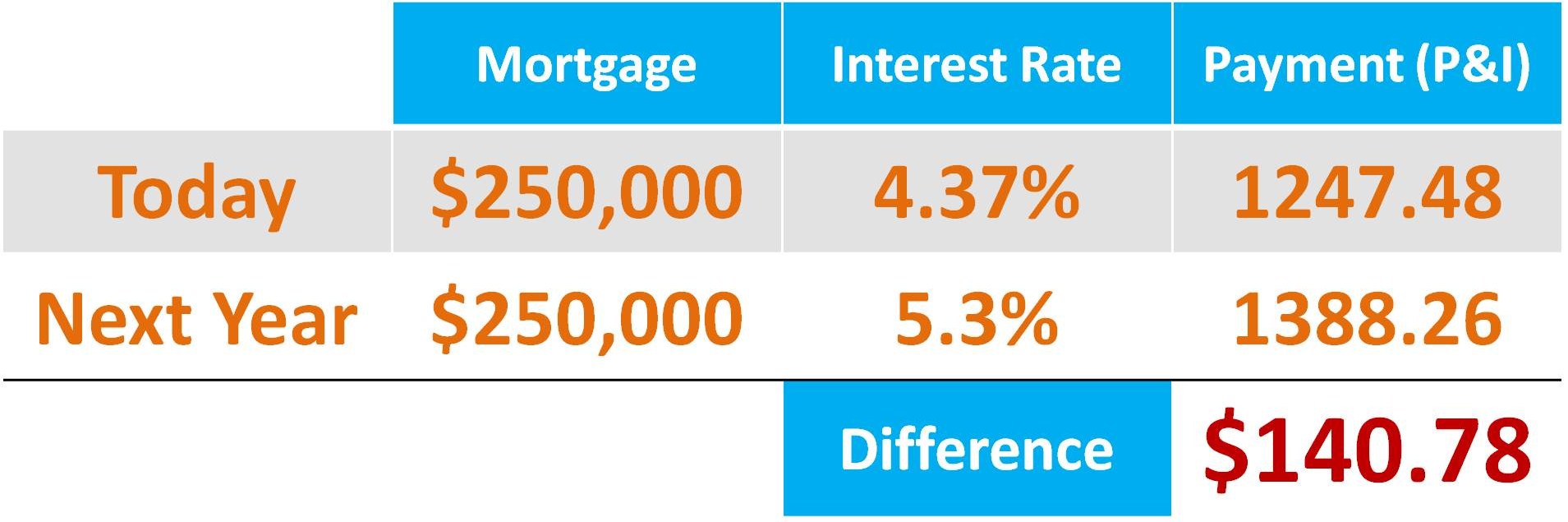

That was great news for any buyer in the process of purchasing a home. However, this window of opportunity is expected to close in the very near future as most experts expect the Fed to taper the bond purchasers in December. Even Ben Bernanke, Chairman of the Fed, suggested that the Fed could still scale back the stimulus this year. He stated: “If the data confirms our basic outlook, then we could move later this year.” Where will mortgage rates head in 2014? The Mortgage Bankers Association, Fannie Mae, Freddie Mac and the National Association of Realtors have each projected that the 30 year fixed rate mortgage will have interest rates in excess of 5% by this time next year. The average of their four projections is 5.3%. The table below shows the impact this will have on the monthly principal and interest payment on a $250,000 mortgage:

|

Does Your Credit Score Effect Your Homeowners Insurance Cost?

|

Does Your Credit Score Effect Your Homeowners Insurance Cost? Posted: 26 Sep 2013 04:00 AM PDT Our guest blogger for today is Carrie Van Brunt-Wiley, Editor of the HomeInsurance.com blog. The HomeInsurance.com blog provides tips for consumers on a wide variety of topics ranging from home maintenance to insurance shopping. – The KCM Crew

You’re likely not surprised when your loan officer asks for your social security number- a thorough credit check is standard when applying for a loan. However, many consumers are caught off-guard when a homeowners insurance agent asks for their social security number. It’s widely debated, but quite commonly practiced- for an insurance carrier to use a customer’s credit score to determine their insurance premiums. What does your credit score really mean to your potential insurance carrier? While many businesses will use a consumer’s credit score to determine eligibility for a line of credit or to discern whether a deposit should be held for an advance of services, insurance companies actually perform a different type of credit inquiry that they use for a very different reason. A “Soft” Credit Check First and foremost, it’s important to know that when an insurance company runs your credit they are actually performing what is called a “soft” credit check which accesses only your credit score and is not reflected as an inquiry on your credit report. As you probably can surmise, this is different from a “hard” credit check that a lender, for example, may run which does show up on your credit report as an inquiry. Since credit inquiries from “hard” credit checks can hurt your overall score it’s good to limit these types of credit checks when shopping for a mortgage, for example. However, since insurance carriers only perform a “soft” credit check you can feel free to shop for multiple insurance quotes without worrying about hurting your credit rating. What they use it for Here’s where a lot of confusion, and sometimes even frustration, can set in from a consumer’s perspective. Once an insurance company has your credit score, they use it (along with many other factors about you and your home, car, etc.) to assign you an “insurance score”. This insurance score reflects your potential risk to the insurer. The insurance carrier then takes your risk potential and calculates your premiums. The more risk you pose, the higher your premiums will most likely be. This is where the real question comes in: What does poor credit history have to do with my potential to file a claim? If you’re asking this question, you’re not alone. There is much debate over the use of credit scoring as a way to determine risk, and therefore assign rates to insurance consumers. However, insurance companies defend the practice saying that studies have shown a direct correlation between a person’s credit score and their likelihood to file a claim. Therefore, consumers with a lower credit score often pay higher rates for insurance. Whether you agree with the practice or not, qualifying for better insurance premiums is just one other way that you can save money by keeping a good credit rating. |

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

Even though no one at KCM actively lists or sells real estate, some of our readers believe that there is an inherent basis toward the real estate community in our writing. For that reason, we want to quote a third party source today. Forbes, in their online edition last week, spoke to the importance of buying a home now rather than waiting.

Even though no one at KCM actively lists or sells real estate, some of our readers believe that there is an inherent basis toward the real estate community in our writing. For that reason, we want to quote a third party source today. Forbes, in their online edition last week, spoke to the importance of buying a home now rather than waiting.

Your credit score and your insurance payments- what’s the connection?

Your credit score and your insurance payments- what’s the connection?