Buying a Home? Don’t Let Fear Get in Your Way!

|

Buying a Home? Don’t Let Fear Get in Your Way Posted: 09 Dec 2013 04:00 AM PST Our founder, Steve Harney, occasionally asks to do a personal post on what he sees as important to our industry. Today we are reposting one of his favorites from this past summer. Enjoy! – The KCM Crew

A smile came across their faces as they talked about decorating their son’s bedroom and how much he will enjoy the backyard. They talked about inviting friends over for dinner and their family over for the holidays. The more they talked, the more excited they became. I asked them if many of their friends were also buying. I was shocked to find out that they weren’t. Why not? Their friends believed that homeownership was financially unobtainable right now. Many wanted to own but didn’t think they could afford the monthly mortgage payment. They decided to rent instead. I said that, with interest rates and prices where they are today, owning a home might not be any more expensive than renting one. The couple agreed but said their friends were afraid; afraid they might not qualify for a loan, afraid to handle negotiations with a seller, afraid of the home buying process itself. Wow! People should not make decisions out of fear! I’m not saying that every young person should own a home. I am saying that anyone that is qualified and wants to buy should not be afraid of the process. I realize the process may seem daunting but realize over 10,000 homes sell every day in this country. Sit down and discuss your goals with professionals from both the real estate and mortgage industries. Get the facts. Make an informed decision. Don’t let the fear of the unknown prevent you from living the life of your dreams. |

Existing Home Sales…

14,027 Houses Sell Every Day in the US!!

|

14,027 Houses Sell Every Day in the U.S.!! Posted: 02 Dec 2013 04:00 AM PST

It is true that more houses sell in the spring than the winter in most markets. However, it is also true that there will be more competition as many sellers wait to the spring to put their house on the market. Thousands of homes sell each and every day in this country. Don’t be afraid to put your house on the market this winter. |

Turkey overload? You might enjoy this…

Turkey overload? You might enjoy this… #Tryptophan Slow Jam: via @youtube http://ow.ly/reOWy

5 Reasons to BUY a Home Now Instead of Spring

5 Reasons to Buy A Home Now Instead of Spring |

|

5 Reasons to Buy A Home Now Instead of Spring Posted: 25 Nov 2013 04:00 AM PST

Supply Is ShrinkingWith inventory declining in many regions, finding a home of your dreams may become more difficult going forward. There are buyers in more and more markets surprised that there is no longer a large assortment of houses to choose from. The best homes in the best locations sell first. Don’t miss the opportunity to get that ‘once-in-a-lifetime’ buy. Price Increases Are on the HorizonPrices are projected to appreciate by over 25% from now to 2018. First home buyers will probably pay more both in price and interest rate if they wait until the spring. Even if you are a move-up buyer, it will wind-up costing you more in net dollars as the home you will buy will appreciate at approximately the same rate as the house you are in now. Owning a Home Helps Create Family WealthWhether you are rent or you own the home you are leaving in, you are paying a mortgage. Either you are paying your mortgage or your landlord’s. The Fed, in a recent study, revealed that the net worth of the average homeowner is 30 times greater than that of a renter. Interest Rates Are Projected to RiseThe Mortgage Bankers Association, the National Association of Realtors, Freddie Mac and Fannie Mae have all projected that the 30-year mortgage interest rate will be over 5% by the end of 2014. That is an increase of almost one full point over current rates. Buy Low, Sell HighWe would all agree that, when investing, we want to buy at the lowest price possible and hope to sell at the highest price. Housing can create family wealth as long as we follow this simple principle. Today, real estate is selling ‘low’ compared to where it will be next year. It’s time to buy. |

Home Buying for Unmarried Couples

Home Buying for Unmarried Couples

Posted: 21 Nov 2013 04:00 AM PST

Today we are excited to have Mark Scheets return as our guest blogger. Mark is a writer for Total Mortgage Services, and often writes about home buying and refinancing.

Throughout the home buying process there can be various hurdles to jump over to make sure everything goes smoothly. In today’s culture, we are finding more often unmarried couples are purchasing their first homes together. Although this sounds like a great plan, there are precautions that need to be taken in order to make sure the process is done right. Doing your research beforehand can alleviate any headaches. From a financial sense it is more difficult to break the co-ownership of a house, than it is to get a divorce, if things turn sour.

Throughout the home buying process there can be various hurdles to jump over to make sure everything goes smoothly. In today’s culture, we are finding more often unmarried couples are purchasing their first homes together. Although this sounds like a great plan, there are precautions that need to be taken in order to make sure the process is done right. Doing your research beforehand can alleviate any headaches. From a financial sense it is more difficult to break the co-ownership of a house, than it is to get a divorce, if things turn sour.

When making the decision to purchase a home with your significant other, you and partner must know that just like with marriage, a property agreement is a legal contract. One of the more important aspects of purchasing a home together is knowing how the investment will be split. In many cases, one partner may initially invest more money into the home than the other. This may cause issues in the future if things don’t work out due to the fact that legally one person may end up owning more of the house than the other.

Plan Now

If the relationship were to end, a dividing of the assets needs to take place. Although everyone in a relationship hopes for the best, preparing for the worst-case scenario will alleviate any hassle in the future. The best way to protect yourself is to come to an agreement as soon as possible while you both are still happy. If there were to be any future issues, it could get real ugly resolving things if steps were not taken care of from the start.

Credit Scores

As an unmarried couple looking to purchase a home together, there are a few concerns you need to be aware of. When the time comes to apply for a mortgage, the lender needs to run both of your credit scores. This can backfire if one of you has a great credit score and one has a terrible score. If this is the case, then you may not get the loan.

Legality

You will also want to check your individual state’s laws regarding an unmarried couple purchasing a home together, as some states don’t allow it. You as the homebuyer need to know this because if you are planning on going through with the purchase and can’t legally, you will be extremely disappointed.

Protect Yourself

Having the right paperwork filed is another important step to take, because without it you could find yourself in trouble in the future. One thing to do early in the home buying process is to file for a Joint Tenancy With Rights Of Survivorship (JTWROS). A JTWROS allows for the home and assets to be passed to the surviving partner if the other were to pass away. This lets the partner avoid inheritance taxes, as the home won’t go through an estate. Married couples are automatically granted JTWROS whereas unmarried couples are not. By doing this you can save yourself a great deal of potential stress in the future.

If you had filed for JTWROS with your partner and something went wrong with the relationship, you would need to fix your agreement. If you don’t adjust past agreements, then your soon to be ex is still entitled to the house and potentially your assets if you were to die. On paper if you had left everything all to your partner but intended to change that and never did, they are still legally getting everything. This also goes for if one partner were to pass away and if you didn’t file for JTWROS, the family of the deceased partner may try to sell the house. If the partner had made a will to leave everything to their family, it would not matter if the surviving partner wished to remain in the home.

What to Adjust After Getting Married

If down the line you and your partner decide to get married, there will be more papers that would need to be altered. The biggest adjustment would need to be the title to the house. After the title is adjusted, creditors cannot single out one of you for bad credit. This is good due to the fact that they cannot add extra interest to that partners share. If you and your soon to be married partner both have good credit, this can work out great if you were looking to refinance once everything is fixed.

As stated, there are precautions that need to be taken when purchasing a home as an unmarried couple. As we all know, getting married is one of the biggest decisions we will make. Planning to buy a home together is a great decision as long as you are cautious about how you go about it.

5 Reasons to Sell Before Spring

|

5 Reasons to Sell Before Spring Posted: 19 Nov 2013 04:00 AM PST

Only Serious Buyers Are OutAt this time of year, only those purchasers who are serious about buying a home will be in the marketplace. You and your family will not be bothered and inconvenienced by mere ‘lookers’. The lookers are at the mall or online doing their holiday shopping. There Is Far Less CompetitionHousing supply always shrinks dramatically at this time of year. The choices for buyers will be limited. Don’t wait until the spring when all the other potential sellers in your market will put their homes up for sale. The Process Will Be QuickerOne of the biggest challenges of the 2013 housing market has been the length of time it takes from contract to closing. Banks have been inundated with both purchase and refinancing loan requests. Both of these will slow in the winter cutting timelines and the frustration these delays cause both buyers and sellers. There Will Never Be a Better Time to Move-UpIf you are moving up to a larger, more expensive home, consider doing it now. Prices are projected to appreciate by over 25% from now to 2018. If you are moving to a higher priced home, it will wind-up costing you more in raw dollars (both in down payment and mortgage payment) if you wait. You can also lock-in your 30 year housing expense with historically low interest rates right now. There is no guarantee rates will remain at these levels in years to come. It’s Time to Move On with Your LifeLook at the reason you decided to sell in the first place and decide whether it is worth waiting. Is money more important than being with family? Is money more important than your health? Is money more important than having the freedom to go on with your life the way you think you should? You already know the answers to the questions we just asked. You have the power to take back control of the situation by pricing your home to guarantee it sells. The time has come for you and your family to move on and start living the life you desire. That is what is truly important. |

Buying a Home? Consider COST not just Price!!

Buying a Home? Consider COST not just Price |

|

Buying a Home? Consider COST not just Price Posted: 18 Nov 2013 04:00 AM PST

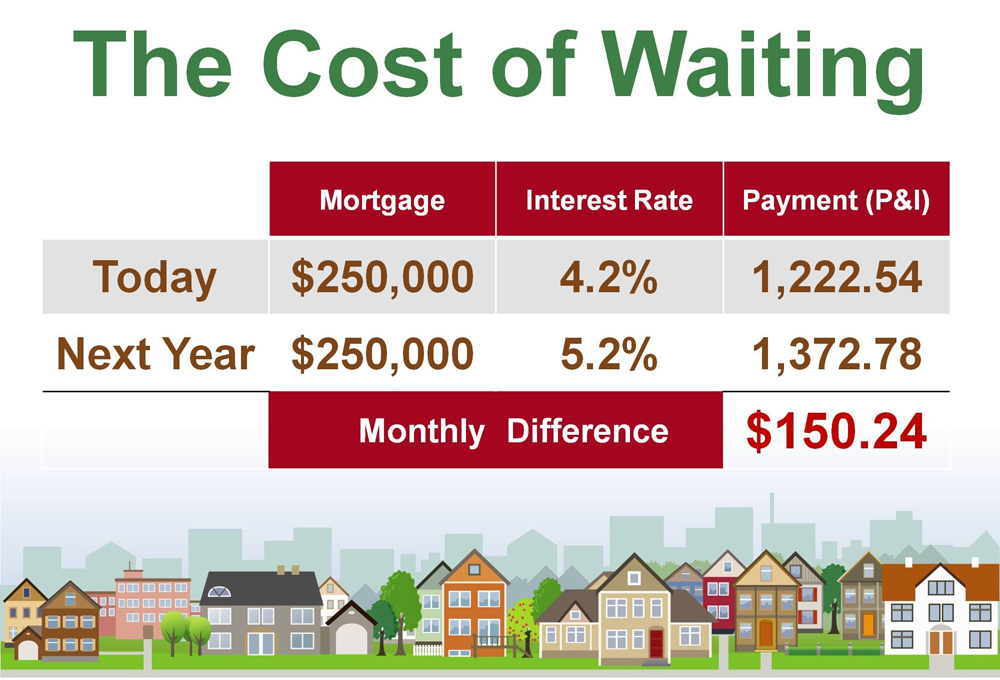

Last month, the Mortgage Bankers Association (MBA), the National Association of Realtors, Fannie Mae and Freddie Mac all projected that mortgage interest rates will increase by about one full percentage over the next twelve months. We also know that many experts are calling for home prices to also increase over the next year. What Does This Mean to a Buyer? Here is a simple demonstration of what impact an interest rate increase would have on the mortgage payment of a home selling for approximately $250,000 even if home prices don’t increase: |

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

Last week, I was talking to a young couple I know that was about to close on their first home. They were riding the wild rollercoaster of current mortgage rate swings and were not happy about the mortgage process overall. Yet, when the conversation shifted to finally living in a home that they own, their disposition changed dramatically.

Last week, I was talking to a young couple I know that was about to close on their first home. They were riding the wild rollercoaster of current mortgage rate swings and were not happy about the mortgage process overall. Yet, when the conversation shifted to finally living in a home that they own, their disposition changed dramatically.

The fixer-upper properties on the market will give you more purchasing power when shopping for a new home. Bargains can be found in homes that have been foreclosed, seized by the government or just fallen out of repair due to homeowner neglect. While it is true that you will save thousands of dollars on these homes that will need lots of work, there are hidden costs that buyers fail to consider. Ask yourself if it’s worth it and know your options.

The fixer-upper properties on the market will give you more purchasing power when shopping for a new home. Bargains can be found in homes that have been foreclosed, seized by the government or just fallen out of repair due to homeowner neglect. While it is true that you will save thousands of dollars on these homes that will need lots of work, there are hidden costs that buyers fail to consider. Ask yourself if it’s worth it and know your options. There are some homeowners that might consider waiting for the spring to sell their house thinking that no one buys a home during the winter months. What we should understand is that homes sell EVERY DAY. As a matter of fact, according to the latest

There are some homeowners that might consider waiting for the spring to sell their house thinking that no one buys a home during the winter months. What we should understand is that homes sell EVERY DAY. As a matter of fact, according to the latest  Based on prices, mortgage rates and soaring rents, there may have never been a better time in real estate history to purchase a home than right now. Here are five major reasons purchasers should consider buying:

Based on prices, mortgage rates and soaring rents, there may have never been a better time in real estate history to purchase a home than right now. Here are five major reasons purchasers should consider buying: Many sellers feel that the spring is the best time to place their home on the market as buyer demand increases at that time of year. However, the fall and winter have their own advantages. Here are five reasons to sell now.

Many sellers feel that the spring is the best time to place their home on the market as buyer demand increases at that time of year. However, the fall and winter have their own advantages. Here are five reasons to sell now. We have often talked about the difference between COST and PRICE. As a seller, you will be most concerned about ‘short term price’ – where home values are headed over the next six months. As a buyer, you must be concerned not about price but instead about the ‘long term cost’ of the home. Let us explain.

We have often talked about the difference between COST and PRICE. As a seller, you will be most concerned about ‘short term price’ – where home values are headed over the next six months. As a buyer, you must be concerned not about price but instead about the ‘long term cost’ of the home. Let us explain.

There will likely be no other time in the lifespan of the Millennial generation that is filled with more opportunity than right now.

There will likely be no other time in the lifespan of the Millennial generation that is filled with more opportunity than right now.