How to Price Real Estate

Posted: 06 Mar 2014 04:00 AM PST

Today we are excited to welcome back Ashley Garner as our guest writer today. Ashley has been a broker for over 20 years in the Wilmington, NC area. – The KCM Crew

Location may have the most effect on value but Price is without question the most important factor controlling the sale of real estate. Anything will sell anytime, how long will it take depends on the price.

Location may have the most effect on value but Price is without question the most important factor controlling the sale of real estate. Anything will sell anytime, how long will it take depends on the price.

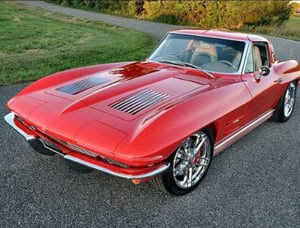

Think about it this way – you may really want to buy a car for your collection and your favorite happens to be a 1963 Corvette. So you hear about one for sale, in mint condition, across town but the only problem is the price, the owner is asking $150,000! Well, although you really, really want a mint condition 1963 Corvette, there is no way you will pay anywhere close to $150,000, in fact you know that the most a 1963 Corvette has ever sold for is about $200,000 and that was for a very rare model, which this one is not.

Because you are a bit obsessed with owning one of these cars you spend almost all of your free time, and some of the time you should be working, searching the internet for available cars. Through this exhaustive search you have become somewhat of an expert on the values of 1963 Corvettes, especially in your town. You happen to know that the particular model for sale across town is worth about $95,000…maybe $100,000. In fact, if the asking price was $100,000 or even $110,000 you would’ve driven over there today with your checkbook and driven home in a 1963 Corvette!

So why don’t you go make an offer? Well, let’s face it when you see a price that is so high compared to the actual value it makes you think that the seller is either difficult to deal with and is out of touch with reality or that he must not really want to sell the car, instead he is just fishing for the one fool in the world that will pay $150,000 for a car that is worth $95,000. So you don’t even go look at it or call for more information…you just keep searching the various websites to find the car of your dreams.

Yes, you guessed it the Corvette in this example actually represents your home or other real estate you might be trying to sell. (in fact it represents any item that can be bought and sold).

Wiggle room = Bad idea

Most sellers think that it is necessary to “leave a little wiggle room” in the price. They think this because they think that all buyers will make aggressively low offers…no matter what the asking price. WRONG!!

Buyers pay the fair market value …in other words they will pay you what it is worth! Your job is to find out what it is worth and price it at or near that value.

This is where brokers and/or appraisers come into the picture. The right way to price your property is to have a professional REALTOR/broker or appraiser prepare a CMA (Comparative Market Analysis) on your property. A CMA involves finding recent sales of similar properties, adjusting for any differences, to arrive at a current market value of your property. Once you have this value you should have your broker set the asking price no more than 3% to 5% higher than that current market value.

If you do this, your property will sell quickly for a price equal to exactly what it is worth, or higher! Buyers as a general rule DO NOT make “low-ball” offers, there are some rare occasions when that happens but the vast majority of initial offers are 5% or less below asking price.

If sellers price their property correctly the buyers will know it immediately because, just like in the Corvette example, buyers spend every spare moment searching the internet for a home, they have made themselves experts on the market value of the particular type of home in the particular area they desire. For this reason the buyer also knows when a property is overpriced. Most buyers will not even go look at a property that is overpriced, they say to themselves “why bother?” they assume that the seller is unreasonable and/or is not truly interested in selling the property.

Yesterday, the Buyer’s Specialist that works for my team and I were showing a house to some buyers who were very motivated had already decided on the neighborhood. The house was well within their price range and met every one of their criteria. As we stood in the kitchen discussing what price we should offer we found ourselves drawn to the fact that the house had been on and off of the market for the last four years!

The conversation immediately turned to “what is wrong with this house?” It turns out that the house hasn’t sold because it was severely overpriced most of that 4 years, it happens to be well priced now but the stigma it carries because of the lengthy time on the market will likely result in it selling for less than it is really worth.

Moral of this whole story is – buyers will pay what it is worth – Seller’s job is to find out what it is worth and set the asking price 3%-5% higher than that number…then sit and wait for the offers to roll in.

Buy Now Don’t Wait for Spring

Posted: 04 Feb 2014 04:00 AM PST

Based on prices, mortgage rates and soaring rents, there may have never been a better time in real estate history to purchase a home than right now. Here are five reasons purchasers should consider buying before the spring market arrives:

Supply Is Shrinking

With inventory declining in many regions, finding a home of your dreams may become more difficult going forward. There are buyers in more and more markets surprised that there is no longer a large assortment of houses to choose from. The best homes in the best locations sell first. Don’t miss the opportunity to get that ‘once-in-a-lifetime’ buy.

Price Increases Are on the Horizon

Prices are projected to appreciate by over 25% from now to 2018. First home buyers will probably pay more both in price and interest rate if they wait until the spring. Even if you are a move-up buyer, it will wind-up costing you more in net dollars as the home you will buy will appreciate at approximately the same rate as the house you are in now.

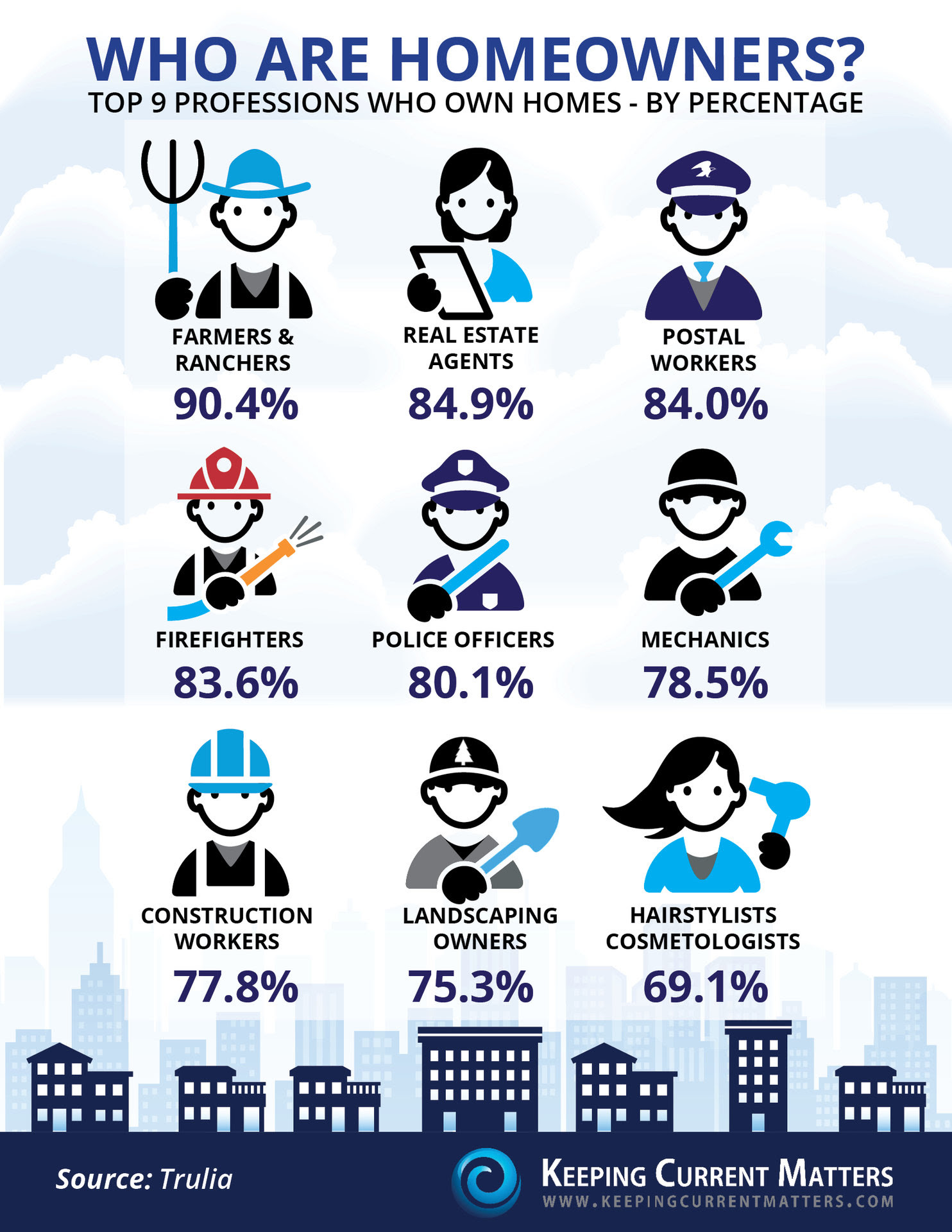

Owning a Home Helps Create Family Wealth

Whether you are rent or you own the home you are living in, you are paying a mortgage. Either you are paying your mortgage or your landlord’s. The Fed, in a recent study, revealed that the net worth of the average homeowner is 30 times greater than that of a renter.

Interest Rates Are Projected to Rise

The Mortgage Bankers Association, the National Association of Realtors, Freddie Mac and Fannie Mae have all projected that the 30-year mortgage interest rate will be over 5% by the this time next year. That is an increase of almost one full point over current rates.

Buy Low, Sell High

We would all agree that, when investing, we want to buy at the lowest price possible and hope to sell at the highest price. Housing can create family wealth as long as we follow this simple principle. Today, real estate is selling ‘low’ compared to where it will be next year. It’s time to buy.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

A

A

Many believe the housing market is in a full out recovery. Others are questioning that assumption. To find out, maybe the only thing we need to do is just open our eyes.

Many believe the housing market is in a full out recovery. Others are questioning that assumption. To find out, maybe the only thing we need to do is just open our eyes. Last month, the Federal Reserve, in a unanimous vote, decided to further decrease its bond purchasing. The bond purchases were the government’s stimulus package created to keep long term mortgage interest rates artificially low in order to help drive the housing market. Most experts believe that tapering will cause interest rates to increase as we move through the year.

Last month, the Federal Reserve, in a unanimous vote, decided to further decrease its bond purchasing. The bond purchases were the government’s stimulus package created to keep long term mortgage interest rates artificially low in order to help drive the housing market. Most experts believe that tapering will cause interest rates to increase as we move through the year. There has been much speculation about what is causing the falling sales numbers in the most recent Existing Home Sales Reports (EHS) from the National Association of Realtors (NAR). Some have claimed that rising interest rates have scared buyers out of the market. Others have claimed that consumers are just losing confidence in the housing recovery fearing a new bubble may be forming. We want to look at the validity of these two assumptions.

There has been much speculation about what is causing the falling sales numbers in the most recent Existing Home Sales Reports (EHS) from the National Association of Realtors (NAR). Some have claimed that rising interest rates have scared buyers out of the market. Others have claimed that consumers are just losing confidence in the housing recovery fearing a new bubble may be forming. We want to look at the validity of these two assumptions.

VA loans are the most misunderstood mortgage program in America. Industry professionals and consumers often receive incorrect data when they inquire about them. In fact, misconceptions about the government guaranteed home loan program are so prevalent that a recent VA survey found that approximately half of all military veterans do not understand it.

VA loans are the most misunderstood mortgage program in America. Industry professionals and consumers often receive incorrect data when they inquire about them. In fact, misconceptions about the government guaranteed home loan program are so prevalent that a recent VA survey found that approximately half of all military veterans do not understand it.