SMARTER.BOLDER.FASTER – check out the C2

SMARTER.BOLDER.FASTER – check out the C21 SuperBowl teaser commercials here! http://ow.ly/8O6kD

How many signs do you need?

How many signs do you need? What is your breaking point? When is enough enough? Are you an early adopter & quick to jump on the band wagon? Or are you the type who plays it ever so safe & then regrets missing the boat?

This is a very unique time in the real estate market. I wish I had a dollar for every time someone asks me about the market, if houses are selling or if I’m busy each week. I am busy, houses are selling and the market is kinda crazy.

- Interest rates are at all-time lows. I had a client who locked in a 30 year fixed loan at 3.75% last week.

- Warren Buffet has told the people closest to him that buying a home right now “will be the best opportunity in [their] lifetime”. Warren Buffet’s personal secretary just purchased a second home in Arizona.

- On the Ames MLS there have been 91 price reductions since January 1st this year, 57 properties have sold and 98 are pending sale.

- Days on Market (on Ames MLS) are down from 127 day average one year ago to 113 days now. Since January 1st I’ve sold two properties that were on the market less than a week when they went sale pending.

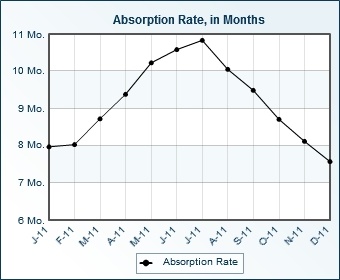

- The Absorption Rate on the Ames MLS is dropping.Absorption absorption rate refers to the number of months it will take to sell all the homes currently listed for sale. We have about 7 1/2 months of inventory.

When the absorption rate is less than five months, it’s considered a seller’s market. When the absorption rate is more than seven months, it’s a buyer’s market. And when the absorption rate is between five and seven months, it’s a balanced, or stable market. If this number keeps dropping…buyers will have missed their market!

What Does Warren Buffet Think About Buying a Home?

The KCM Blog: What Does Warren Buffet Think About Buying A Home?

|

| What Does Warren Buffet Think About Buying A Home?

Posted: 30 Jan 2012 04:00 AM PST

![gty_warren_buffett_ll_110815_wg[1]](http://www.kcmblog.com/wp-content/uploads/2012/01/gty_warren_buffett_ll_110815_wg1-300x168.jpg) Warren Buffet is seen by many as the greatest investor of our time. When he speaks, people listen. Like anyone else in his position of influence, he is criticized by some for using his bullhorn to promote his own business agendas at times. That makes it very interesting when we occasionally learn of how he privately advises those closest to him. Warren Buffet is seen by many as the greatest investor of our time. When he speaks, people listen. Like anyone else in his position of influence, he is criticized by some for using his bullhorn to promote his own business agendas at times. That makes it very interesting when we occasionally learn of how he privately advises those closest to him.Such a situation occurred this week. Debbie Bosanek, Warren Buffet’s secretary of 37 years, recently purchased a second home in Surprise, Arizona. In an article in the Omaha World Herald, Mrs. Bosanek discussed her reasons for purchasing a second home and the personal advice she received from Mr. Buffet.

The greatest investor of the last century privately has told the people closest to him that buying a home right now “will be the best opportunity in [their] lifetime”. That’s good enough for us. How about you? |

It’s definitely warming up…

It’s definitely warming up…the market that is!

It’s mid-January and I already have 5 deals pending. currently negotiating 3 offers and have a bunch of serious buyers ready to buy. I haven’t had a January this busy since…wait I’ve never had one this busy!

Yes, I think the incredibly mild winter we’ve been having (until now) has helped keep the real estate game in motion. It also helps that the media has toned down their daily trashing of how they think real estate caused the entire economic crisis. Or maybe its the lowest interest rates in history (I have a client getting a 30 yr, fixed rate mortgage at 3.75%!)

In the first 20 days of this year, there have been 41 properties sell and 65 properties go pending. That’s not a bad start!

Time to Buy? What’s everyone else think?

Top 5 Reasons to Buy a Home in 2012

Top 5 Reasons to Buy a Home in 2012

by Jonathan Slappey on JANUARY 6, 2012 in Home Buying

The American dream of homeownership is a very feasible aspiration for 2012.

The American dream of homeownership is a very feasible aspiration for 2012.

There are many benefits of owning a home. Yet some first-time buyers are skeptical of purchasing with the uncertainty surrounding the housing market.

The uncertainty many reference when speaking about the housing market involves a specific date when home values will increase. Since no one can pinpoint this date, the word uncertainty (when paired with the housing market) often reveals a negative connotation.

There are some factors we can be certain about in this housing market such as home values rebounding. This is true; the housing market often moves in cycles.

It’s safe to assume that many Americans harbored the same uncertainty during the George H. W. Bush administration in the early 1990s when the national homeownership rate fell from its previous historic high of 64.4 percent in 1980 to a low of 64.1 percent in 1991.

In the 1960s Lyndon Johnson illustrated a correlation between homeownership and accountability by stating “owning a home can increase responsibility and stake out a man’s place in his community…The man who owns a home has something to be proud of and reason to protect and preserve it.”

This statement is still true more than 50 years later. There are many reasons to take pride in homeownership such as:

- Appreciation – Buying a home now (at the current rates) can almost ensure your home’s appreciation in the future. Mortgage rates are near historic lows and home prices in many parts of the country are down. This is the perfect recipe for home appreciation. Additionally, many foreclosed homes are available for a fraction of the original cost. This can translate to a higher profit if you decide to sell once the market rebounds.

- Property Tax Deductions – For income tax purposes, real estate property taxes for a vacation home and first home are fully deductible. The IRS (Publication 530) provides detailed tax information for first-time buyers that may answer many questions about what deductions homeowners are eligible for.

- Preferential Tax Treatment – If you own your home for more than a year and receive more profit than the allowable exclusion after the sale of your home, the profit will be considered a capital asset. Capital assets are given preferential tax treatment.

- Equity Building – Many factors such as credit qualification, loan flexibility, and annual percentage rate (APR) contribute to the final decision of what type of mortgage loan best fits your goals. Yet, a new trend being used by some homeowners is to actually add money to their monthly payment to decrease the principal balance of their loans at a much faster pace. This trend is called equity building. Equity builders usually select a home loan with a lower interest rate (and a shorter term loan such as a 15-year fixed) to help build equity faster. This rapid payment process allows borrowers to:

- Pay off the principal balance faster

- Lock in near-record-low interest rates

- Shorten the length of their home loan

- Own their home faster

- Pay substantially less mortgage interest

Equity building is a beneficial trend that’s becoming more and more popular with fiscally responsible homeowners. Also, home equity is the largest single source of household wealth for most Americans.

- Pride – Homeownership offers many benefits to many different types of people. For some homeowners, playing your music as loud as you want and painting the walls the color of your choice is a perk. For me, homeownership will permit me to build an NBA regulation size basketball court on my own property. For my coworker Joel Jarvi, home ownership may allow him to build the indoor slide of his dreams. No matter who you are, homeownership is a purchase, commitment, and journey that’s sure to bring you pride.

Furthermore, when the uncertainty surrounding the housing market fades and the market rebounds, homeownership may in fact transform that pride to profit through a home sale.

Jonathan Slappey is a writer for Quicken Loans, a company whose clients believe it’s Engineered to Amaze. Interested in being Amazed by us? Read trusted reviews at our review site.

Read more: http://www.quickenloans.com/blog/top-5-reasons-buy-home-2012#ixzz1jeXTIbzf

The Power of Assumability

One of the rarely touted advantages of people taking FHA mortgages today is the fact that they are assumable. What that means is, when the FHA homebuyer of today is looking to sell his home, a qualified purchaser can “take over” their loan.

Most people believe that interest rates will return to a “normal” range (between 6.5% and 7%) in a couple of years. When you assume a mortgage, the terms remain the same. This means that a buyer five years from now can enjoy a 4 – 4.5% mortgage by assumption rather than the 6.5% – 7% mortgage they would get without it. Since most people buy homes based on how the monthly payment fits into their personal monthly budget, this is extremely impactful.

As an example, a $300,000 loan at 4% today carries with it a $1,432.25 principal and interest payment on a 30 year fixed mortgage. If offered for sale in five years, the purchaser could assume the $271,858.56 balance with the same $1,432.25 payment and remaining term of 25 years. The total payments over the 25 years would be $429,675.

Compare that to a new $272,000 loan at 6.5% for 25 years, which would carry a monthly payment of $1,836.56 (over $400 more a month than the assumption and more than $120,000 more over the 25 year term).

At 6.5% for 25 years, to wind up with the same payment as the assumed mortgage, our borrowers would only be getting $212,000…$60,000 LESS!

The point here is that, when rates go up, homes with assumable mortgages will have more value and will sell at higher prices because they are more affordable. As an additional bonus, the closing costs on assumable mortgages are significantly less (especially here in New York where NYS Mortgage Tax is such a large component of closing costs).

The borrowers must be credit-worthy of course (have good credit, qualifying income, and necessary assets to close), but they would have to be credit-worthy to get a new mortgage too!

Besides the multiple other reasons to obtain an FHA mortgage (low down payment requirements, extended income ratios, lower credit scores, and easier sourcing of funds), there is another perk. In the future, there is a good chance that you may be able to sell your home for more money because of the FHA loan’s assumability.

People Are Buying Homes & GETTING MORTGAGES!

| People Are Buying Homes AND GETTING MORTGAGES!

Another interesting fact in the report was that 72% of these transactions were accompanied by a mortgage. That means that approximately 8,719 people qualify for a mortgage on a daily basis in this country. There are over 12,000 homes sold and over 8,000 mortgages granted every day. The real estate market is doing better than many believe. |

When the Prophet Says Buy – Buy!!

| When the Prophet Says Buy – BUY!

Mr. Talbott, the person who accurately predicted the housing bubble and its bust, now has a new prediction – IT IS THE TIME TO BUY A HOME! In a recent article, Homes – Buy Now!, Talbott simply explains:

He goes on to explain that his conclusion is based on four different metrics, all of which favor buying today:

Bottom LineIf the person who called the real estate bubble and its bust says now is the time to buy, we believe it is time to buy. |

10 Home Winterization Musts

10 home winterization mustsHave you changed your furnace filter lately?By Bill and Kevin Burnett

It’s been a mild winter throughout most of the country so far. That means we still have time to run through a foul-weather checklist. Here are 10 “must do’s” to have a warm, cozy and safe winter. 1. Check attic insulation. A foot of blown-in or batt insulation (R-38) in the attic reduces heat transfer from heated interior space to the great outdoors. This is a do-it-yourself job. If your attic is not insulated, blow in or roll out 12 inches of loose or batt insulation. If the amount of insulation is less than 12 inches, simply roll out unfaced fiberglass batts over the existing insulation to create a heavier thermal blanket. This is a case where more is better. Make sure to leave soffit vents unobstructed. 2. Install or replace weatherstripping, if necessary. Check the rubber threshold gasket at the bottom of exterior doors and replace if worn or torn. Next, make sure the top and sides of the door are weatherstripped and fit tightly. If there are gaps, replace the weatherstripping. 3. Check exterior doors and windows for gaps. Modern windows are probably OK, but older windows may need some help. To reduce air leakage, casement windows might need some weatherstripping at the joint where fixed and movable panes meet. Old double-hung wood windows are notorious air leakers. Place pieces of narrow self-adhesive rubber weatherstripping on the bottom sides and at the joint where the top and bottom panes meet. 4. Check the outside of doors and windows for voids, and caulk any gaps you see. 5. Change the filter in the heater. In older furnaces, filters should be changed monthly. Change or service newer, more efficient filters according to the manufacturer’s instructions. 6. Replace your old thermostat with a new programmable model. This allows you to regulate the heater to warm the house when you’re there and to reduce the temperature when you are at work or asleep. 7. Have your heater inspected by a licensed heating and air conditioning contractor. An inspection ensures that the heater is operating safely and efficiently. In many cases an inspection can alert you as to whether the unit is at the end of its life. It’s nice to have the option to replace an old heater before it quits and becomes an emergency on a cold January day. 8. Check the carbon monoxide (CO) detector. If you don’t have one, get one. Carbon monoxide is an odorless and colorless gas that kills. An operating CO detector can prevent a tragedy. While you’re at it, check the smoke detectors to ensure they’re operable. 9. Clean gutters and downspouts so fallen leaves won’t clog them. Make sure that downspouts discharge away from the foundation and that soil is graded away from the foundation and at least 6 inches below the siding. 10. Clean the fireplace of ashes; visually check the chimney for loose or missing mortar. Also consider having the chimney professionally inspected and swept by a licensed and bonded chimney sweep. |

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

Many believe that very few houses are selling and that almost no one can get a mortgage. We want to let everyone know that neither of these assumptions is true. Recently, the National Association of Realtors (NAR) released their

Many believe that very few houses are selling and that almost no one can get a mortgage. We want to let everyone know that neither of these assumptions is true. Recently, the National Association of Realtors (NAR) released their  John R. Talbott, previously a Goldman Sachs investment banker, is a bestselling author and economic consultant. When it comes to the housing market he is also a prophet. When housing prices started to skyrocket in 2003, he published The Coming Crash in the Housing Market correctly warning us that a real estate bubble was forming. Then in January 2006, he called the absolute peak of home prices in the US by releasing a new book, Sell Now! The End of the Housing Bubble.

John R. Talbott, previously a Goldman Sachs investment banker, is a bestselling author and economic consultant. When it comes to the housing market he is also a prophet. When housing prices started to skyrocket in 2003, he published The Coming Crash in the Housing Market correctly warning us that a real estate bubble was forming. Then in January 2006, he called the absolute peak of home prices in the US by releasing a new book, Sell Now! The End of the Housing Bubble.