|

Buying a Home: The Cost of Waiting Posted: 01 Jul 2014 04:00 AM PDT

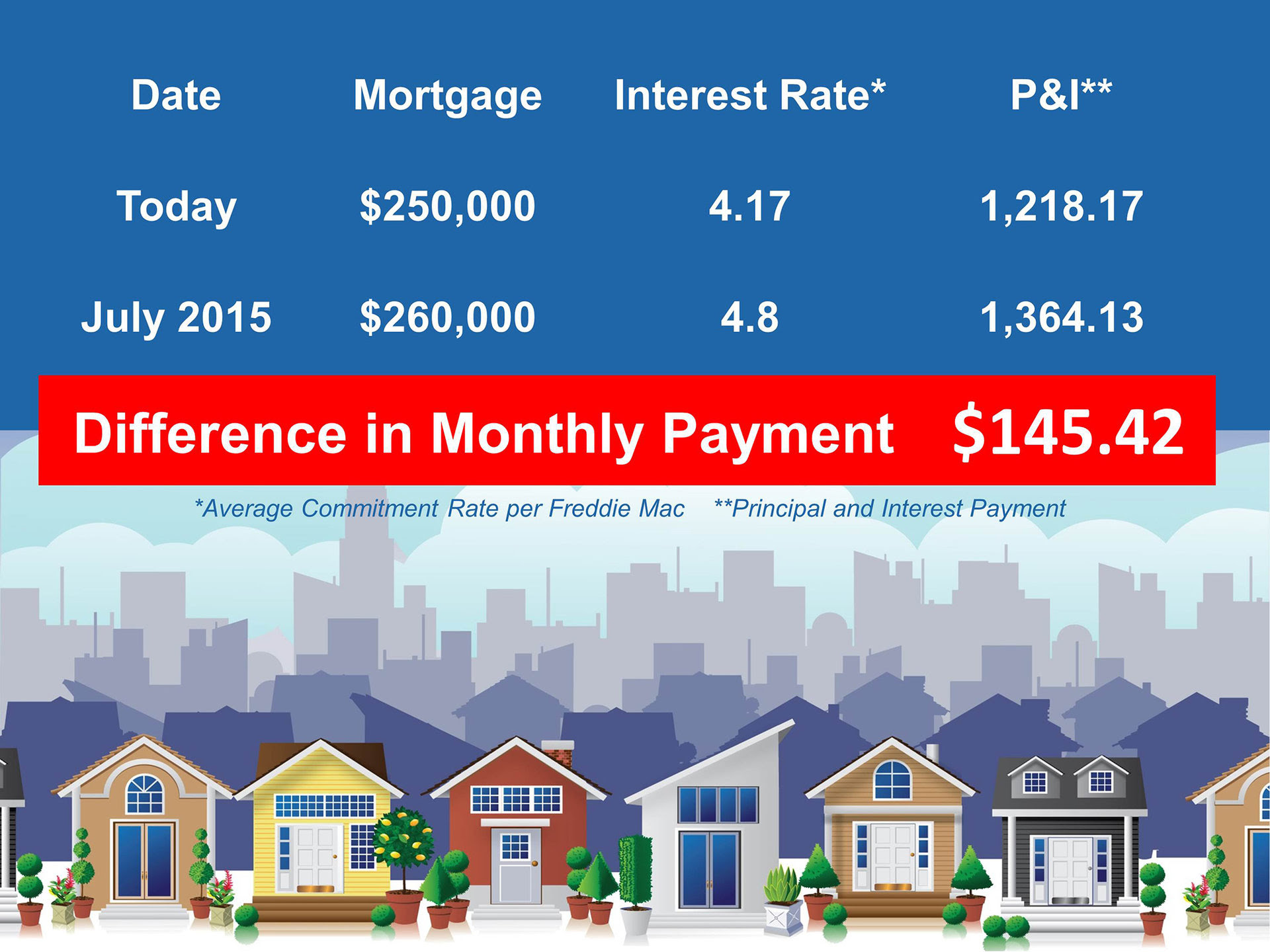

Whether you are a first time buyer or a move-up buyer, you should look at the projections housing experts are making in two major areas: home prices and mortgage rates. PRICESOver 100 economists, real estate experts and investment & market strategists wererecently surveyed. They were asked to project where home prices were headed. The average value appreciation projected over the next twelve month period was approximately 4%. MORTGAGE INTEREST RATESIn their last Economic & Housing Market Outlook, Freddie Mac predicted that 30 year fixed mortgage rates would be 4.8% by this time next year. As of last week, theFreddie Mac rate was 4.14%. What does this mean to you?If you are a first time buyer currently looking at a home priced at $250,000, this is what it could cost you on a monthly basis if you wait to buy next year:

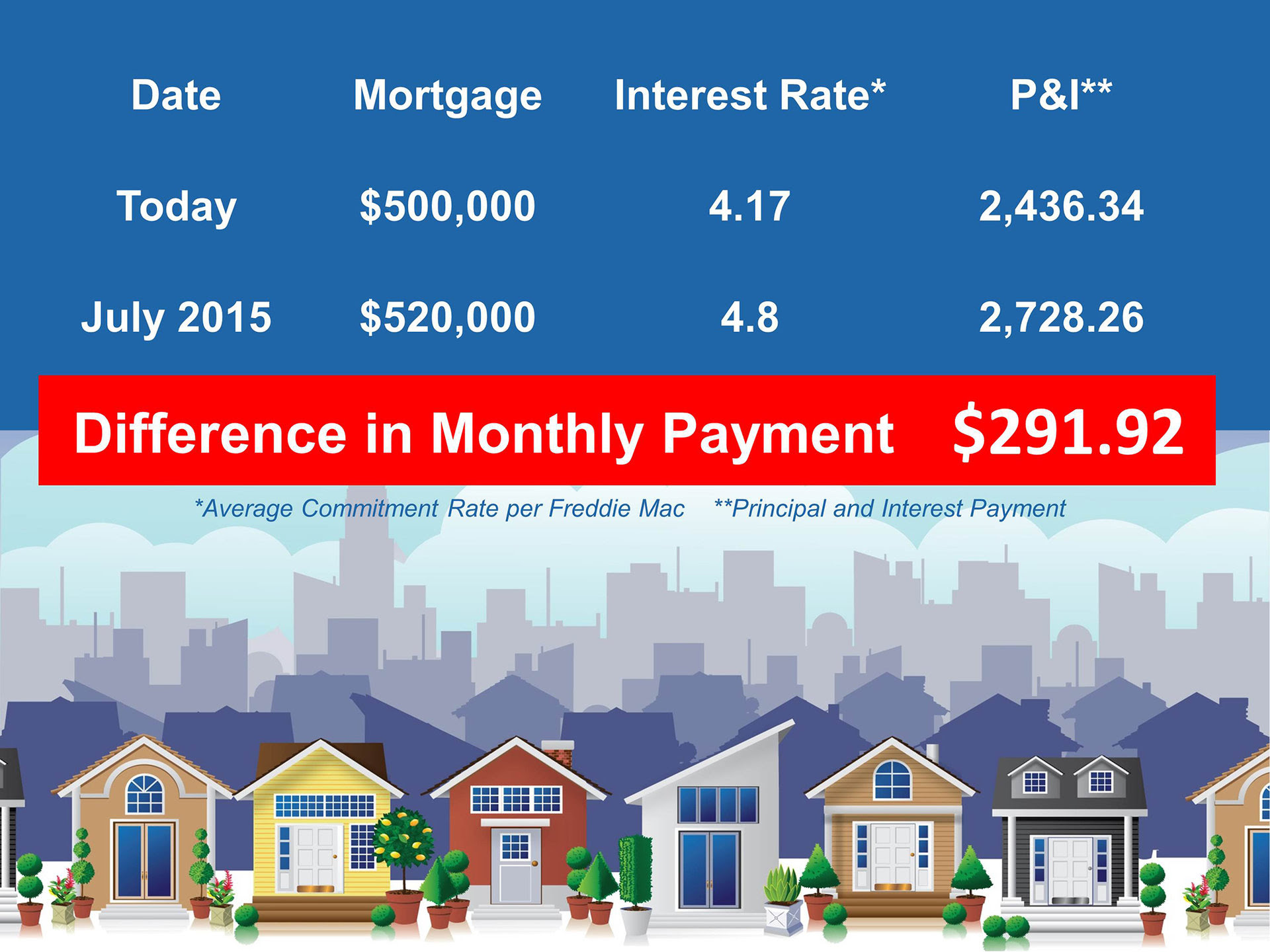

If you are a move-up buyer currently looking at a home priced at $500,000, this is what it could cost you on a monthly basis if you wait to buy next year:

Bottom LineWith both home prices and interest rates projected to increase, buying now instead of later might make sense. |

Uncategorized •

July 1, 2014

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link